Table of Content

Past-due card accounts represented 4.04% of all receivables in the second quarter, versus the all-time high of 4.07% in the previous two quarters. You may be entitled to additional free credit reports in certain circumstances, such as after placing a fraud alert, becoming unemployed or receiving public assistance, or being denied credit or insurance in the past 60 days. Credit Cards Explore tips on getting the right credit card for you and what it means for your credit. Plus, managing credit card debt and what to do if you lost your card. The bankers association’s survey of more than 300 banks nationwide was conducted before the Federal Reserve’s recent cuts in key interest rates. Standard & Poor's said delinquencies on home-equity lines of credit issued in 2005 and 2006 shot up in March, underscoring continued trouble in the U.S. economy.

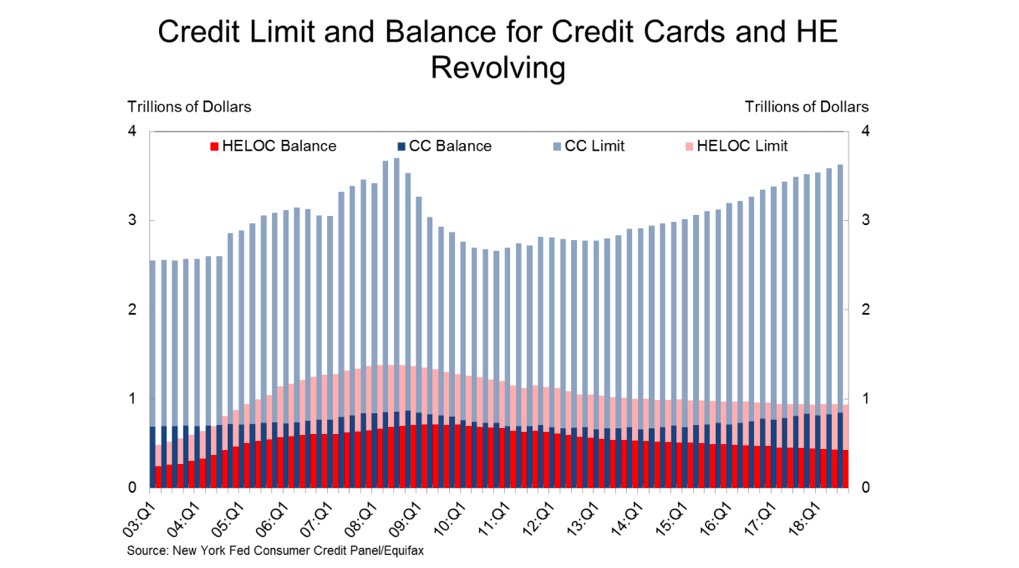

When consumers default on their home loans, they risk having no place to live, so they tend to pay their mortgage and home-equity lines first, followed by car loans and credit cards, Naroff says. "That people are now having trouble making payments on home-equity lines is a clear sign of the extent of the pressure on the household budgets," he says. The latest data from Equifax, which covers the first eight months of the year, found that banks originated a record 54 million credit cards through Aug. 31. That was 16.4 percent more than the first eight months of 2021, which represented the previous record high.

Banks face another post-crisis hangover as bills come due on lines of credit extended during property boom

The "fundamental problem" behind high delinquency rates remains a weak economy that is not producing jobs, Mr. Chessen said. The average number of weeks consumers have remained unemployed rose to 19.5 in the second quarter, from 18.3 in the first quarter. The dominant theme in the credit card world this year, by far, was sharply higher interest rates. At Bankrate, we’ve been tracking credit card rates since 1985, and the current average of 19.42 percent is the highest we’ve ever seen. In fact, in 2022, we observed the steepest single-year increase on record.

The delinquency rate on credit card bills fell to 4.39 percent from 4.41 percent in the first quarter, the bankers group said. If you have $5,000 in credit card debt and you only make minimum payments, the jump from 16.30 percent to 19.42 percent adds seven months to your payback cycle and costs you an extra $1,173 in interest. If your rate is 20.55 percent (the initial 16.30 percent plus the 4.25 percentage points in Fed hikes), minimum payments will take you nine additional months and an extra $1,579 to pay off compared with the start of the year. WASHINGTON - Late payments on U.S. home equity lines of credit rose to a 5-1/2 year high in the second quarter of 2007 but delinquencies on many other types of consumer loans fell, the American Bankers Association said on Wednesday.

The Bankrate promise

Would highly recommend him for his Honesty, Integrity and Insights that both informed and protected us. Honestly, as long as you dont go asking attorneys for free services or trying to sue everyone who angers you, he's great to work with. Others complaining are either asking him to work for free or trying to sue someone for something stupid. You may change your billing preferences at any time in the Customer Center or call Customer Service.

In its quarterly report on consumer borrowing, the bankers group said the percentage of home equity lines that were more than 30 days past due rose to 1.1 percent from 0.96 percent the prior quarter. The troubles with housing debt contrasted with an improvement seen with other consumer loans, the bankers group said. More homeowners seeking to pay off credit card debt will also be more likely to take out a HELOC to pay off those higher-interest loans. U.S. credit card debt hit an all-time high this year, and a surge in delinquencies is expected to follow in 2023. Delinquencies for credit card and personal loan payments are expected to reach highs in 2023 not seen in more than a decade, according the latest forecast from TransUnion. He offered sound solutions and resolved the issues quickly and professionally.

How to break the credit card debt cycle

Obviously, these higher-rate scenarios are getting progressively worse, but to be honest, none of them are pretty. Minimum payments toward $5,000 at 16.30 percent certainly weren’t a picnic. Those would have kept you in debt for 185 months and cost you a grand total of $5,517 in interest. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Falling home equity and stock values, job losses, rising food and energy costs, and slow income growth have stretched consumers in the first quarter.

In the meantime, used car prices are already declining, making them more affordable for consumers. Understood and he has an air of confidence I appreciated I would highly recommend Rob. The knowledge that he has shared has taken the stress out of dealing with situations that seemed very complex.

The average credit card rate has increased 312 basis points (3.12 percentage points) since Jan. 1. Worldwide credit markets have been shaken in recent months by a sharp rise in U.S. home mortgage delinquencies involving subprime, or less credit-worthy, borrowers. In some cases, subprime loans made a year or more ago are resetting at significantly higher interest rates than consumers realized.

Debt Management Learn how debt can affect your credit scores, plus the different types of debt , and best practices for paying it off. Credit Reports Understand how your financial behavior impacts you and your credit, along with what is included on your credit reports and why. Take control with a one-stop credit monitoring and identity theft protection solution from Equifax. Sign Up NowGet this delivered to your inbox, and more info about our products and services. S&P said that 9.19% of lines issued in 2005 and 11.45% of loans issued in 2006 are delinquent, up 6.49% and 6.51% from February.

The 15-year fixed rate this week averaged 4.5% with an average upfront fee of 0.7%, down from last week’s 4.54% and 4.83% a year earlier. Gary Kaltbaum owns Kaltbaum Capital Management, LLC (“KCM”), a state registered investment adviser. The opinions expressed herein are those of Mr. Kaltbaum and may not reflect those of KCM. The information offered in this publication is general information that does not take into account the individual circumstances, financial situation or individual needs of an investor.

Easily lock and monitor your Equifax credit report with alerts. Help look after your family with credit monitoring and ID theft protection features. Our Sales Specialists will provide strategic guidance and match you to the best products and solutions. "The tax stimulus is helping to boost personal income, but persistently high gas and food prices will eat away at overall resources," he said. That rate is the highest since the ABA started collecting the data in 1987.

No comments:

Post a Comment