Table of Content

Easily lock and monitor your Equifax credit report with alerts. Help look after your family with credit monitoring and ID theft protection features. Our Sales Specialists will provide strategic guidance and match you to the best products and solutions. "The tax stimulus is helping to boost personal income, but persistently high gas and food prices will eat away at overall resources," he said. That rate is the highest since the ABA started collecting the data in 1987.

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

How to break the credit card debt cycle

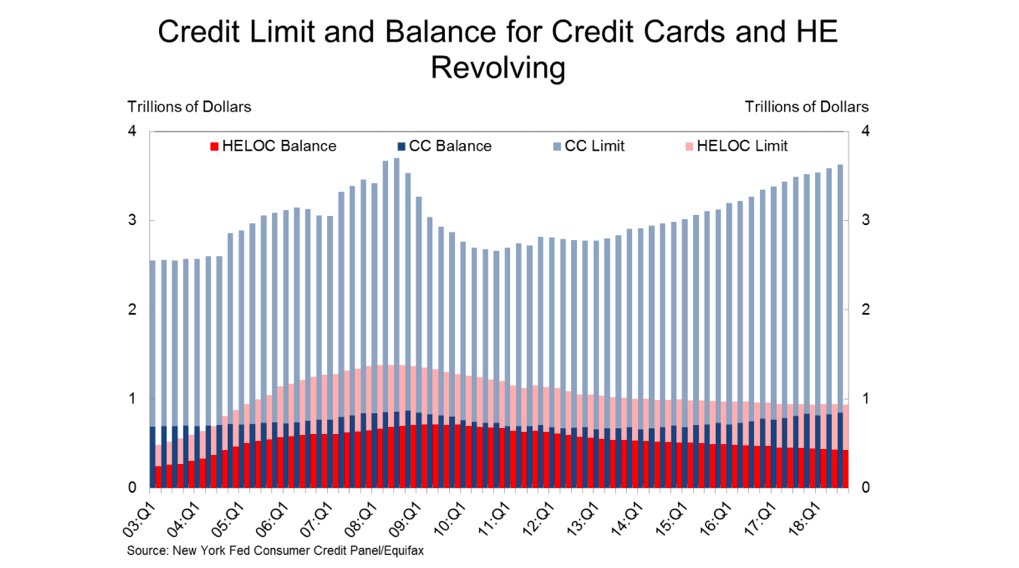

In its quarterly report on consumer borrowing, the bankers group said the percentage of home equity lines that were more than 30 days past due rose to 1.1 percent from 0.96 percent the prior quarter. The troubles with housing debt contrasted with an improvement seen with other consumer loans, the bankers group said. More homeowners seeking to pay off credit card debt will also be more likely to take out a HELOC to pay off those higher-interest loans. U.S. credit card debt hit an all-time high this year, and a surge in delinquencies is expected to follow in 2023. Delinquencies for credit card and personal loan payments are expected to reach highs in 2023 not seen in more than a decade, according the latest forecast from TransUnion. He offered sound solutions and resolved the issues quickly and professionally.

Many consumer loans are bundled into “asset-backed” securities, and sold to investors including institutions, pension funds and mutual funds. Further economic slowing might drive late payments higher, hurting the value of these securities. When it came to paying credit card bills in the second quarter, consumers improved, according to the report. Closed-end home equity loans consist of a fixed amount with a fixed rate while borrowers using home equity lines of credit have a capped limit and are usually subject to adjustable interest rates.

How a new credit card can fight against inflation

Obviously, these higher-rate scenarios are getting progressively worse, but to be honest, none of them are pretty. Minimum payments toward $5,000 at 16.30 percent certainly weren’t a picnic. Those would have kept you in debt for 185 months and cost you a grand total of $5,517 in interest. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Falling home equity and stock values, job losses, rising food and energy costs, and slow income growth have stretched consumers in the first quarter.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Blair will succeed longtime executive Kessel Stelling as chairperson of the bank's board of directors after joining Synovus in 2016 and moving into the CEO position last April. "The mobile home loan dropped very significantly," he said. "That's an important one - the mobile home one tends to be a proxy for lower-income consumer borrowing. To see improvements in that is, I think, a very positive sign." Place or manage a freeze to restrict access to your Equifax credit report, with certain exceptions.

Equifax Premium Products

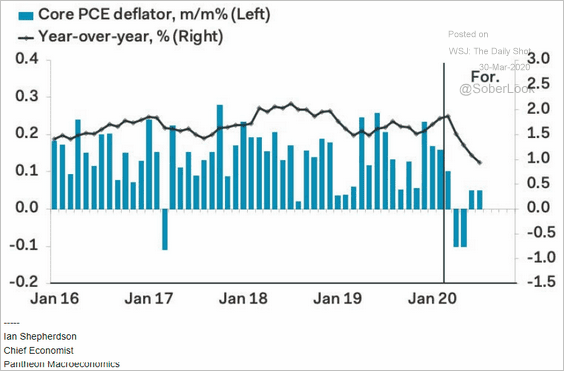

You will be notified in advance of any changes in rate or terms. You may cancel your subscription at anytime by calling Customer Service. The 15-year fixed rate this week averaged 4.5% with an average upfront fee of 0.7%, down from last week's 4.54% and 4.83% a year earlier. This year’s increase is all about the Federal Reserve and its series of interest-rate hikes meant to combat the highest inflation readings in four decades. The Fed has raised the federal funds rate by 425 basis points in 2022. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

Get free credit monitoring if you are an active duty military or National Guard member. Personal Finance Discover personal finance tips and tricks around everything from managing your money to saving and planning for the future. Fraud & Identity Theft Explore ways to better protect your information, plus warning signs of fraud and identity theft, and what to do if you believe your identity has been stolen. Credit Scores Understand credit scores, credit worthiness, and how credit scores are used in day-to-day life. Get the basics with your monthly credit score and report. Get better prepared to monitor your credit and help better protect your identity with Equifax Complete™.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.

Get peace of mind when you choose from our comprehensive 3-bureau credit monitoring and identity theft protection plans. Chessen said borrowers with an adjustable rate mortgage should carefully review the terms of the resetting rates and contact their lenders immediately to discuss options. The average, which applies to loans taken out by borrowers with good credit and at least a 20% down payment or 20% home equity, was 5.14% last week and 5.1% two weeks ago.

"In the past, we always knew that the demand for coal would rebound and the jobs would come back," Roberts said. Also, Roberts called for more government spending to improve the nation's roads, bridges and other infrastructure, saying such investments would help improve steel markets and protect the jobs of miners who produce metallurgical coal. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Meet you wherever you are in your credit card journey to guide your information search and help you understand your options. The National Defense Authorization Act passed by the Senate did not include a pot banking provision, but did include provisions on Fed master accounts and allowing banks to hire ex-cons.

I expected issuers to cut back on the number of interest-free months and/or raise transfer fees. Neither has happened, at least among the most attractive balance transfer cards. If anything, the competition has intensified, as Bank of America recently joined Citi and Wells Fargo in offering 21-month interest-free terms on certain cards. Total balances are just a smidge below the pre-pandemic high set in Q4 2019, and rates are at record highs. Yet delinquencies and defaults are well below typical levels and card companies didn’t need to overextend their marketing budgets to acquire new customers. In other words, this year, card companies had their cake and ate it too.

Debt Management Learn how debt can affect your credit scores, plus the different types of debt , and best practices for paying it off. Credit Reports Understand how your financial behavior impacts you and your credit, along with what is included on your credit reports and why. Take control with a one-stop credit monitoring and identity theft protection solution from Equifax. Sign Up NowGet this delivered to your inbox, and more info about our products and services. S&P said that 9.19% of lines issued in 2005 and 11.45% of loans issued in 2006 are delinquent, up 6.49% and 6.51% from February.

While that seems friendly enough at first glance, upon further inspection, I believe it would be the exact opposite. Despite worries about high inflation and a potential recession, credit is still flowing freely. As of October, just 18 percent of credit card applicants were rejected, according to the Federal Reserve. That’s in line with most of the past decade and down from a peak of 26.3 percent in Feb. 2021.

Home Equity Delinquencies Jump

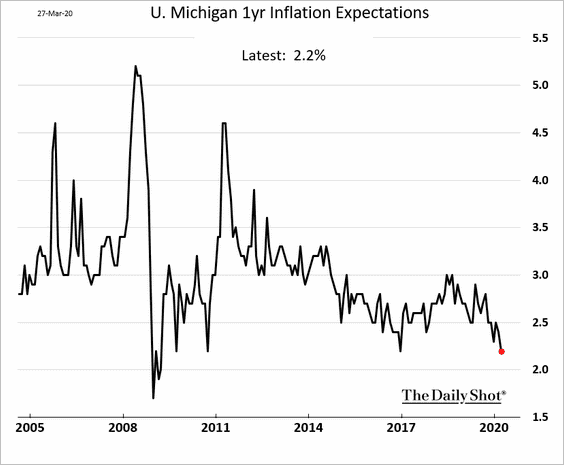

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. In the latest indication of these pressures, late payments on home-equity lines of credit rose to an 11-year high in the first quarter of 2008, according to the American Bankers Association. "The housing market has been cooling for a while," he said. "Some portion of the consumer population has been living on their home equity appreciation. If home equity appreciation is slowing, it reduces the amount of incremental borrowing," and people may have problems paying back their loans.

Borrowers paid an average of 0.7% of the loan amount in upfront lender charges, or points. INSOL International is a worldwide federation of national associations for accountants and lawyers who specialize in turnaround and insolvency. There are currently 43 member associations worldwide with more than 9,000 professionals participating as members of INSOL International. As a member association of INSOL, ABI's members receive a discounted subscription rate. Reversing the district court's affirmance of the bankruptcy court's conclusion that a judgment debt was non-dischargeable under Sect. 523, the Ninth Circuit Court of Appeals held that application of the unclean hands doctrine to absolve an attorney of responsibility for stealing from his client would be contrary to the public interest.

No comments:

Post a Comment