Table of Content

First, any home equity debt not used to buy, build, or substantially improve the home. If you have home acquisition debt incurred after December 15, 2017, go to line 7. Fill out only one Table 1 for both your main and second home regardless of how many mortgages you have. At all times during the year, at least 80% of the total square footage of the corporation's property is used or available for use by the tenant-stockholders for residential or residential-related use. Explain how to divide the excess interest among the activities for which the mortgage proceeds were used. A mortgage may end early due to a prepayment, refinancing, foreclosure, or similar event.

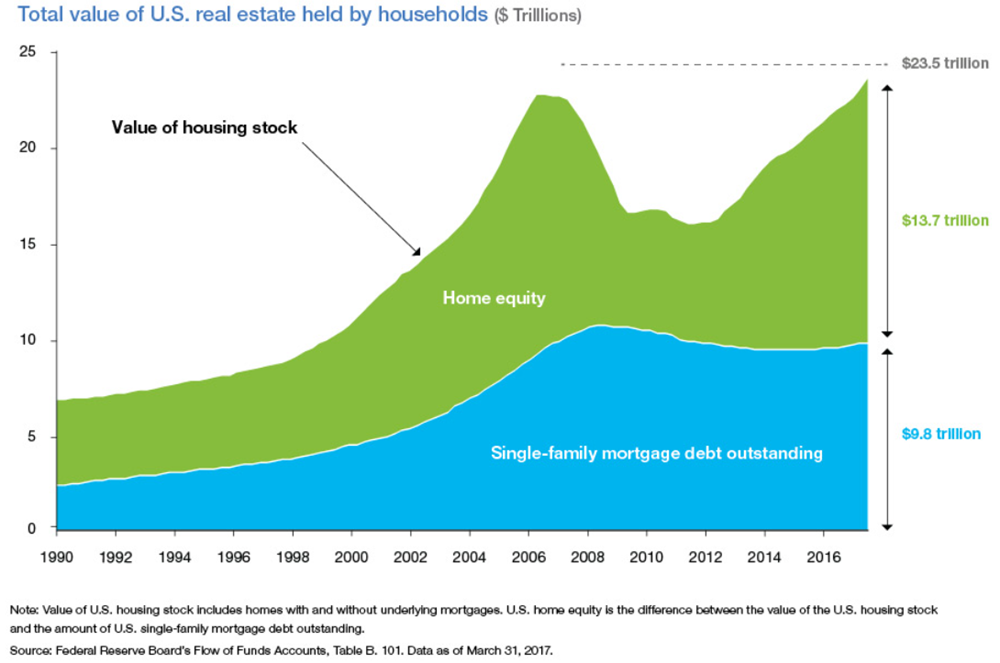

Under the old tax rules, you could deduct the interest on up to $100,000 of home equity debt, as long as your total mortgage debt was below $1 million. A mortgage interest deduction allows homeowners to deduct mortgage interest from taxable income. HELOC rates are only slightly higher than first mortgage rates, making HELOCs much less expensive than other loan options. Of course, whether a HELOC is a good deal or not can depend on the current interest rate environment. HELOC rates are usually set based on the prime rate, which in turn is influenced by the federal funds rate.

Will I Get Any Money Back From My Taxes

Home equity loans use equity in the borrower’s home as collateral. Taking out a home equity loan therefore means putting the borrower’s home at risk. If the borrower fails to pay back the loan, the lender can foreclose and sell the home to pay off the debt. This means that your total mortgage debt can’t exceed $750,000 to deduct the interest.

Unless you have an exceptionally large HELOC or home equity loan, the interest paid on it is unlikely to be the deciding factor in taking the standard deduction or itemizing deductions. If you are already itemizing your deductions, then choosing a HELOC or a home equity loan over something like a personal loan so that you can deduct the interest may make the most financial sense for you. Keep in mind that the attractiveness of a HELOC—and its deductibility—can change if interest rates rise.

Choose Between a Standard or Itemized Deduction

When she's not writing or reading, you can usually find her planning a trip or training for her next race. Also, the loan has to be secured by the home that is being purchased, built or improved. If a borrower uses a home equity loan secured by a primary residence to buy, build or improve a vacation home, the interest is not deductible. Use our tool to get personalized estimated rates from top lenders based on your location and financial details. Select Home Equity Loan, enter your ZIP code, credit score and information about your current home to see your personalized rates.

HELOCs typically have variable interest rates, meaning the monthly payment could fluctuate over time. Your eligibility and personalized interest rate will be based on how well you meet a lender’s requirements. For instance, a higher credit score and lower DTI ratio should get you more favorable terms. Once satisfied with the terms, you’ll complete a more thorough application. The lender, in turn, will then do a more thorough underwriting. This includes performing a hard pull of your credit report and requiring proof of your income.

When a home equity loan results in a tax break

However, the home you used the funds to buy, build, or improve must be the collateral for the loan. You actually have a couple of choices when you're looking to borrow against your home. Your first choice is to take out a home equity loan and pay it off over time. Your second option is a home equity line of credit, or HELOC. With home equity lines of credit, you're not borrowing a lump sum upfront.

527, Residential Rental Property, and 535, Business Expenses.personal interestnot deductible. You can't deduct the amount of interest on line 16 as home mortgage interest. If you didn't use any of the proceeds of any mortgage included on line 12 of the worksheet for business, investment, or other deductible activities, then all the interest on line 16 is personal interest.

Furthermore, banks can raise credit standards for HELOCs when an economic downturn occurs. To be deductible, the money must be spent on the property in which the equity is the source of the loan. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals.

The limits above are reduced by the amount of your grandfathered debt . However, you can treat a debt as secured by the stock to the extent that the proceeds are used to buy the stock under the allocation of interest rules. Receives at least 80% of its gross income for the year in which the mortgage interest is paid or incurred from tenant-stockholders.

You should consider deducting the interest on your home equity loan if you used the cash to “buy, build or substantially renovate your home,” according to the IRS. This may be a bit of a surprise if you took out a home equity loan after Dec. 15, 2017, when the Tax Cut and Jobs Act was passed. You can draw what you need against the line of credit, pay interest only on what you’ve used and then pay it back. HELOCs typically have terms that allow you to repeat that process over a 10-year period.

Getting a HELOC when one is available also makes more cash accessible in an emergency. Again, interest on a HELOC only applies when homeowners use the money, so the cost of getting one is relatively low. Therefore, it can be a good move to get one if you think that you might lose your job. If you wait until after a job loss, then you might not have sufficiently good credit to get a HELOC.

No comments:

Post a Comment